CRISPR and Its Slight Setback

The firm had a bit of a setback due to Phase 1 results of a recent trial.

While a large portion of the results were positive, a portion of these results did indicate some slight issues with infections.

A physician that works at the firm, Crispr Therapeutics did state: “Furthermore, we have the potential to improve upon already observed efficacy with a consolidation dosing strategy. Based on these encouraging results, we are planning to expand CARBON into a potentially registrational trial in the first quarter of 2022.”

But while it does show efficacy at the start, investors are taking pause because of a few issues. Durable remissions as a part of this current study are present over 17% of the time after half a year.

That is an issue because similar studies from other companies have been able to obtain better rates. But this does not mean that CRISPR is wholly affected and impaired. The firm will have regular clinical trials take place over the next couple of years.

Still investors are not assuaged.

A Buying Opportunity?

Does this represent a buying opportunity for CRISPR? Potentially. If you believe that the company will have staying power over the next few years, then yes. The biotechnology and gene-editing firm has increased its cash on hand year over year and seems poised to increase its lineup of offerings.

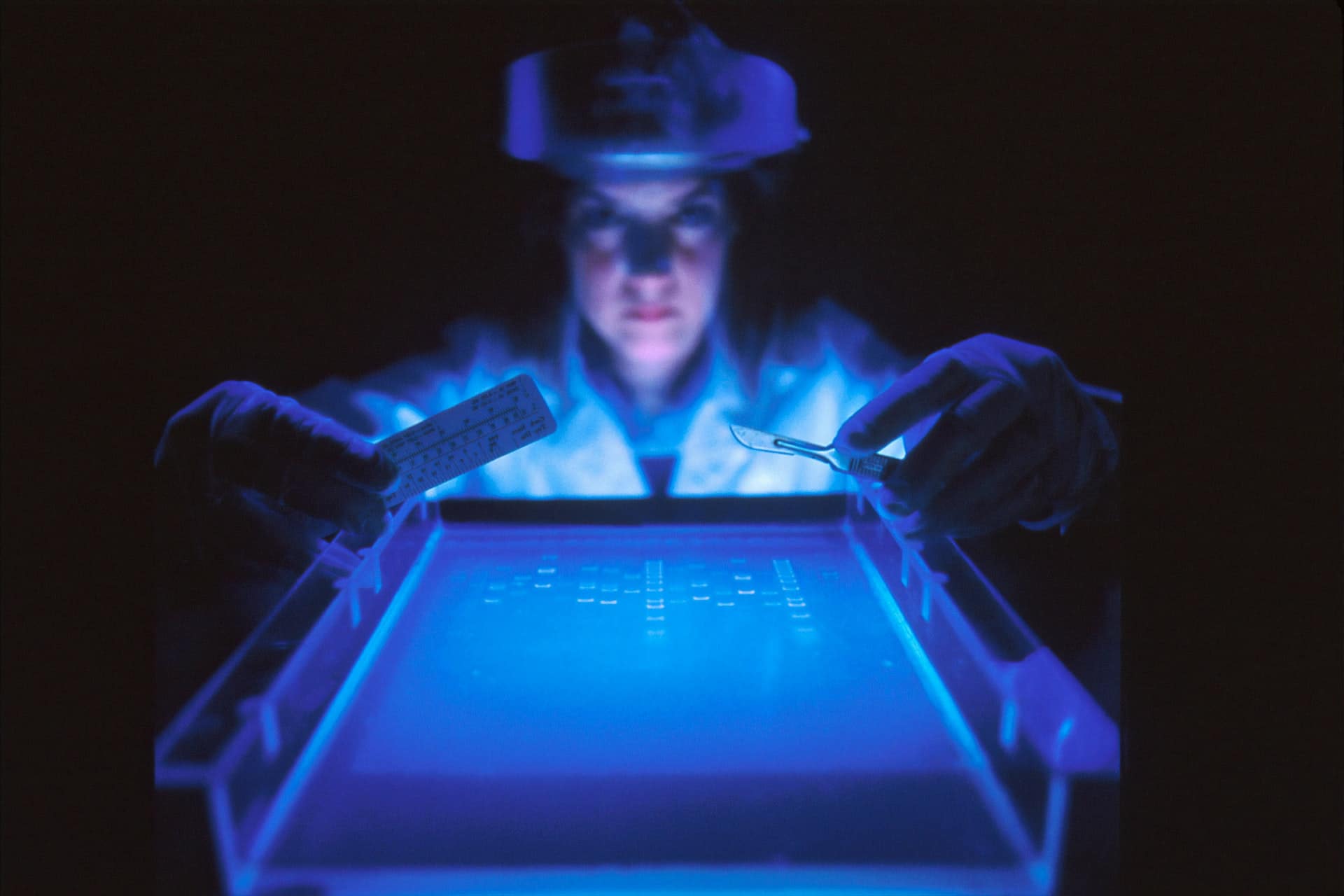

The field of gene-editing is still relatively new and firms that seek to provide therapies via precise and directed changes to genomic DNA are still conducting heavy research.

But the problem is that you are investing in the future with this stock. The firm does not have remarkable earnings, dilutes its stock, and continues to burn money on research and development.

This is what you are expecting from a future leaning company. On the plus side, with the advent of the novel covid-19 vaccines, it would appear that genomic therapy is now in vogue. This field should obtain much more interest and demand over the next decade.