Fabric by Gerber Life: Digital Life Insurance for Families

In today's fast-paced world, modern families face unique financial challenges. Juggling careers, childcare, and future planning requires tools that are not only effective but also accessible and intuitive. The life insurance market has seen significant growth, with total new annualized premiums increasing by 8 percent in early 2025, reflecting a growing awareness of the need for financial protection. Fabric by Gerber Life emerges as a direct response to this need, offering a digitally-native platform designed to simplify financial security for the modern household. This article provides a comprehensive overview of Fabric by Gerber Life, exploring its core offerings, the synergy of its brand, and its place in the broader landscape of family financial planning.

What is Fabric by Gerber Life?

Fabric by Gerber Life is a financial services company that offers term life insurance and a suite of financial wellness tools through a streamlined digital experience. Initially launched as Fabric, an independent startup focused on making financial protection accessible for parents, the company was acquired and rebranded to leverage the established trust and market presence of Gerber Life Insurance Company. This strategic move combined Fabric's innovative technology and user-centric design with the long-standing reputation of a household name in family-focused insurance.

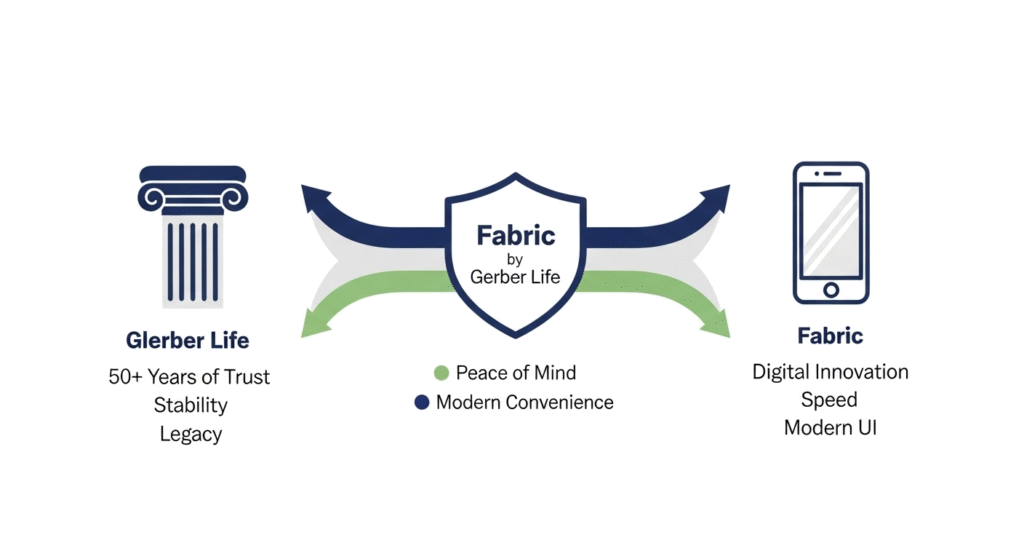

The Synergy: Gerber Life's Legacy Meets Digital Innovation

Fabric by Gerber Life combines the established trust of a legacy insurer with the convenience of a modern, digital-first platform.

The union of Fabric's modern platform with Gerber Life's decades of experience creates a compelling value proposition. Gerber Life has been a trusted name for over 50 years, synonymous with protecting children and families. This legacy provides a foundation of stability and reliability. Fabric brings a deep understanding of the digital consumer to the table, offering an application process that can be completed in minutes, not weeks. This synergy means customers get the best of both worlds: the peace of mind that comes with a policy backed by a financially strong institution and the convenience of a modern, mobile-first interface.

Who is Fabric by Gerber Life For? Modern Families Seeking Simple Solutions

Fabric by Gerber Life is specifically tailored for modern families, particularly parents with young children. This demographic often finds itself time-poor and in critical need of straightforward financial safety nets. With the economic pressures families face—such as parents spending an average of 22% of their household income on child care—affordable,parents report spending an average of 22% of their household income on child care easy-to-understand solutions are paramount. The platform is ideal for tech-savvy individuals who prefer managing their finances online and value the integration of multiple financial tools, such as life insurance, will creation, and investment accounts for their children, all in one place.

Understanding Fabric's Core Offering: Life Insurance Made Easy

Fabric’s primary goal is to demystify life insurance, transforming it from a complex, often intimidating process into a simple, manageable task. By focusing on a core product and streamlining its delivery, the company makes essential financial protection more accessible than ever before.

Fabric's Approach to Life Insurance

The company's philosophy centers on simplicity, speed, and transparency. Fabric eliminates the cumbersome paperwork and lengthy waiting periods often associated with traditional insurance providers. Their algorithmic underwriting allows many qualified applicants to receive an immediate decision and obtain coverage without a medical exam. This digital-first approach respects the time and priorities of busy parents, allowing them to secure coverage efficiently from the comfort of their own homes.

Demystifying Term Life Insurance

Fabric specializes in term life insurance, which is often the most suitable and affordable option for families. Term life insurance provides coverage for a specific period, or “term”—typically 10, 15, 20, 25, or 30 years. If the insured person passes away during this term, their beneficiaries receive a tax-free death benefit. This payout can replace lost income, cover mortgage payments, fund a child's education, and settle final expenses. Considering the national median cost of a funeral was $8,300 in 2023, and total direct costs can approach $20,000, a term life policy provides a critical financial buffer during a difficult time.

Exploring Available Riders and Enhancements

While Fabric's primary focus is on providing straightforward term life insurance, they do offer options for policy customization. One of the most common is the Accidental Death Benefit rider. This enhancement provides an additional payout to beneficiaries if the insured's death is the result of a covered accident. This rider can add an extra layer of financial security for a relatively small increase in premium, offering greater peace of mind for families concerned about unexpected events.

The Application Process: Getting Coverage with Fabric

Fabric has revolutionized the application process. Prospective customers can apply online or through the mobile app in about 10 minutes. The process involves answering a series of questions about health, lifestyle, and family history. For many applicants aged 18 to 60 seeking coverage up to a certain amount, Fabric's technology can provide an instant decision without requiring a medical exam. This accelerated underwriting is a key differentiator, removing a major hurdle that often deters people from getting the coverage they need.

Understanding Life Insurance Rates and Factors Affecting Premiums

Life insurance premiums are determined by a variety of risk factors. Key determinants include age, gender, health status, family medical history, lifestyle choices (such as smoking), and occupation. The coverage amount and the term length also significantly affect the cost. Fabric's transparent online quoting tool allows users to see how these variables affect their potential premium, empowering them to make informed decisions that align with their budget and financial goals.

Beyond Protection: Investing in Your Children's Financial Future

Fabric by Gerber Life extends its mission beyond immediate protection by offering tools that help families plan for long-term financial goals, particularly for their children.

The Fabric by Gerber Life Kids Investment Account (UGMA)

A standout feature is the Fabric by Gerber Life Kids Investment Account, which is structured as a Uniform Gifts to Minors Act (UGMA) account. This custodial account allows parents, grandparents, and other adults to invest money on behalf of a child. The adult manages the account until the child reaches the age of majority in their state, at which point the assets become legally theirs. These accounts offer greater flexibility than 529 plans, as the funds can be used for any purpose that benefits the child, not just education.

Holistic Family Financial Planning with Fabric

By bundling life insurance, investment accounts, and other tools, Fabric encourages a holistic approach to family finances. This integrated ecosystem allows parents to manage both their family's immediate security and its long-term growth within a single, user-friendly platform. This is particularly valuable, given that a staggering 55% of Americans have no estate planning documents —a gap Fabric helps 55% of Americans have no estate planning documentsaddress by keeping these crucial financial components top of mind.

Exploring Potential Tax Benefits and Long-Term Growth

UGMA accounts can offer certain tax advantages. A portion of the investment earnings may be taxed at the child's lower tax rate, an effect often referred to as the “kiddie tax.” These accounts provide a vehicle for long-term, tax-efficient growth, allowing families to build a substantial nest egg for their children's future milestones, whether that's college, a down payment on a home, or starting a business.

Trust and Stability: The Foundation Behind Fabric by Gerber Life

In the world of insurance, trust is paramount. Fabric by Gerber Life is built on a foundation of financial strength and a commitment to customer transparency, ensuring policyholders can feel confident in their choice.

The Strength of Western & Southern Financial Group

Gerber Life Insurance Company, the issuer of Fabric's policies, is a member of Western & Southern Financial Group. This parent company is a Fortune 500 company with a long history of financial stability and high ratings from major credit rating agencies like A.M. Best. This backing provides a robust assurance that the company has the financial fortitude to meet its obligations to policyholders for years to come.

Transparency in Practice: essentialConsumer Complaints and Ratings

Fabric by Gerber Life maintains high ratings across various consumer platforms. The company is accredited by the Better Business Bureau (BBB) and holds an A+ rating. It's essential for consumers to review feedback from multiple sources. While any large company will have some consumer complaints, reputable insurers demonstrate a commitment to resolving these issues. Prospective customers should look at the nature of complaints and how the company responds to them as part of their due diligence.

Fabric's Commitment to Customer Experience and Support

From its intuitive app to its responsive support team, Fabric prioritizes a positive customer experience. The platform is designed to be self-service, empowering users to easily manage their policies and accounts. However, when assistance is needed, a team of licensed agents and customer support specialists is available to answer questions and provide guidance, ensuring users feel supported throughout their financial journey.

Making an Informed Decision: Is Fabric Right for Your Family?

Choosing a life insurance provider is a significant decision. Evaluating the advantages and potential limitations of Fabric by Gerber Life in the context of your family's unique needs is a critical step.

The Advantages of Choosing Fabric by Gerber Life

The primary benefits include speed, convenience, and affordability. The digital application process is a major draw for busy individuals. The integration of valuable free tools, like a legally valid will creator and a kids' investment account, provides a holistic financial planning experience that few competitors match. Furthermore, the backing of Gerber Life and Western & Southern provides a level of economic stability and trust that is essential for a long-term product like life insurance.

Considerations and Potential Limitations

Fabric's focus on simplicity may make it not the ideal choice for everyone. The company exclusively offers term life insurance, so individuals seeking permanent policies like whole life or universal life will need to look elsewhere. Additionally, the range of available policy riders is more limited compared to some traditional insurers, offering less opportunity for complex customization.

Comparing Fabric to Other Life Insurance Companies

When compared to traditional insurance companies, Fabric's key advantage is its speed and digital-first model. Compared to other digital “insurtech” competitors, Fabric's main differentiators are its strong brand heritage through Gerber Life and its suite of integrated family-focused financial tools. While some competitors may offer slightly different term lengths or coverage amounts, Fabric's holistic package is specifically designed to appeal to the parental market.

Getting Started and Managing Your Fabric by Gerber Life Account

The user experience with Fabric is designed to be seamless from onboarding to ongoing policy management, reflecting its commitment to modern convenience.

The Seamless Onboarding Process

Getting started is as simple as downloading the app or visiting the website. The initial quote and application process is guided and straightforward, with clear instructions at every step. For those who qualify for instant approval, coverage can be secured in a single session, providing immediate peace of mind.

Managing Your Life Insurance Policy and Investment Account Digitally

Once a policy is active, the Fabric app or online portal serves as a central hub for all management tasks. Users can view policy documents, update beneficiary information, manage payments, and monitor the performance of their children's investment accounts. This centralized control provides unparalleled convenience and transparency.

Adjusting Coverage and Updating Information as Your Family Grows

Life is dynamic, and financial needs change. As your family grows, your income increases, or you take on new financial responsibilities like a mortgage, it's important to review your life insurance coverage. While a term policy's death benefit cannot typically be increased, Fabric makes it easy to apply for additional coverage. Users can also effortlessly update personal information and beneficiaries directly through the platform.

Conclusion: Securing Tomorrow, Today, with Fabric by Gerber Life

A Modern Solution for Modern Families

Fabric by Gerber Life has successfully carved out a niche by addressing the specific needs of modern parents with a solution that is simple, digital, and comprehensive. By blending the innovative spirit of a tech startup with the enduring trust of an established insurance provider, it offers a compelling package of protection and planning tools. The platform empowers families to take control of their financial security without the traditional barriers of complexity and time commitment.

Your Family's Financial Future, Simplified and Secured

For families seeking an affordable and straightforward way to secure a financial safety net, Fabric by Gerber Life presents a formidable option. Its focus on term life insurance, coupled with invaluable tools for estate planning and children's investments, creates a holistic ecosystem for financial wellness. The next step for interested individuals is to visit their website, utilize the free quoting tool to assess potential costs, and explore the integrated features to see how they align with their family's long-term financial goals. Taking these simple steps today can provide lasting peace of mind for tomorrow.