Three Top Oil Dividend Stocks You Should Consider to Purchase

Best Oil Stocks That Pay Dividends

The previous few years have been difficult for oil firms. Since dropping from $100 per barrel in 2014, the price of oil, which directly affects how much money most oil firms make, has not yet rebounded. In 2020, oil prices even briefly fell to zero.

As a result, investors haven’t been especially interested in oil equities, but things might change in 2021. At around $80 per barrel, oil prices are close to multiyear highs, so it’s time to look at some oil stocks that could provide investors with sizable dividend payouts in 2022. But of course, if you don’t have time to do it, but you need money now, you can take same day loans and improve your situation.

Helmerich & Payne

Energy firm Helmerich & Payne, Inc. (NYSE: HP) specializes in oil and gas drilling. The company comes in at number 10 on our list of the top dividend-paying oil stocks because it offers drilling services and solutions to exploration and production firms.

Just last July, BofA analyst Chase Mulvehill raised Helmerich & Payne, Inc. from Underperform to Neutral, and Scott Gruber of Citigroup raised the stock from Sell to Neutral in the same month. Additionally, Gruber increased Helmerich & Payne, Inc.’s price objective from $24 to $33.

Helmerich & Payne, Inc., which surpassed projections by $0.03, had an EPS of -$0.60 in the second fiscal quarter of 2021. Revenue for the business came in at $296.17 million, above projections by $5.56 million. The stock price of Helmerich & Payne, Inc. has increased by% during the last six months and by% so far this year.

21 of the 866 hedge funds that Insider Monkey has been following have investments in Helmerich & Payne, Inc. as of the end of the first quarter of 2021, totaling about $152 million.

ExxonMobil Integrated

ExxonMobil Integrated is a major oil company ExxonMobil (NYSE: XOM) is one of the biggest oil producers in the world. Oil and natural gas products are discovered, extracted, and refined by it. Exxon pays a $0.88 per share quarterly dividend, for a total of $3.52 per year and a 5.34% dividend yield. a sum of money distributed to shareholders from a company’s profits.

Although they can do so at any time, public firms that pay dividends often do so on a predetermined timetable. Special dividends or extra dividends are terms used to describe unexpected dividend payments.

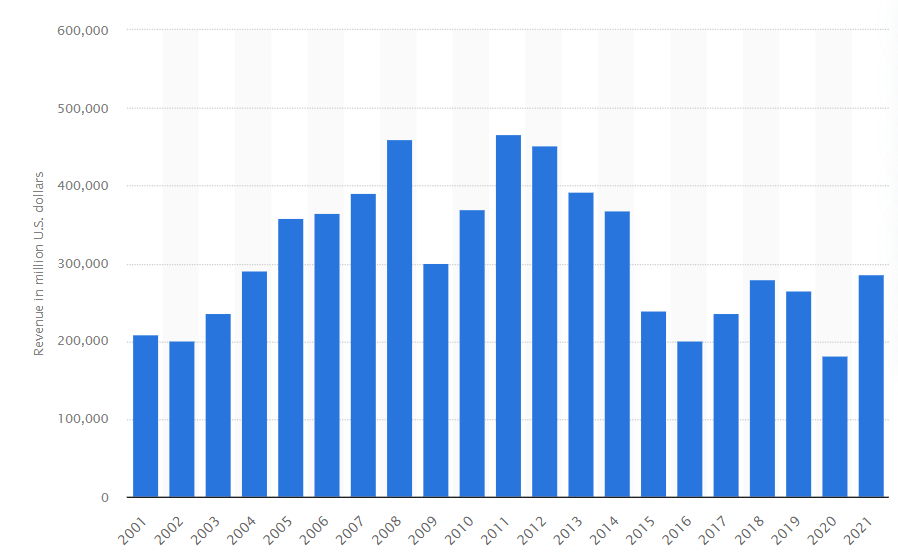

After 38 years of dividend payments and increases, ExxonMobil recently came close to cutting the dividend. Exxon’s free cash flow in 2016–2017 and 2020 was choked off by the drop in oil prices, as shown in the above chart. Increasing capital expenditures from 2018 to 2020 is a result of the company borrowing money to pay the dividend while also investing heavily in pricey oil projects.

The epidemic put the company under a financial strain, forcing management to reconsider that approach and make cost reductions. With the rise in oil prices, free cash flow is increasing, putting the business back on sound financial footing.

Its debt-to-capital ratio, which compares total liabilities to total capital to determine how indebted a firm is, is a respectable 26%. (lower is better). In other words, its cash flow is sound again, and its balance sheet is solid. In 2021, ExxonMobil’s operational revenue was around 285.6 billion USD.

Enbridge

In order to transport energy resources throughout North America, Enbridge is crucial. The Canadian corporation operates in the midstream energy sector, and its pipelines and storage facilities assist in moving fossil fuels from their points of extraction (mostly in Canada) to their points of consumption throughout Canada and the United States. You may compare pipeline stocks to railroads in that they generate revenue by charging manufacturers to carry goods via their pipelines.

Enbridge has established itself as a reliable business over time because it is more dependent on the volume of oil and gas it transports than the price at which those commodities are traded. Enbridge operates like a Dividend Aristocrat even if it isn’t officially one as it isn’t a part of the S&P 500 and has increased its dividend for 27 years and counting. Additionally, investors benefit from the highest beginning dividend yield of all three equities at 6.6% today.

Diamondback Energy

Independent oil and gas producer Diamondback Energy (FANG) concentrates its operations in West Texas’ Permian Basin. This year’s share price growth of 33% is actually quite disappointing.

This is due to the fact that FANG is a sector underperformer. The energy sector of the S&P 500 has had a YTD price increase of more than 60%. Analysts claim that FANG’s relative underperformance has just prepared it for future disproportionate profits. The Street projects an implied price upside of 26% for the company over the next year or so, with an average target price of $181.40.

When the generous dividend yield is taken into account, the implied 12-month total return is close to 32%.

Bulls point to FANG’s attractive valuation as well as management’s dedication to returning cash to shareholders through dividends and buybacks as reasons to be optimistic about the stock.

Chevron

Chevron is one of the biggest oil corporations in the world and a supermajor. Its integrated activities include a wide range of the oil industry’s facets. Over the next five years, Chevron expects output to expand at a 3% compound annual growth rate (CAGR). Management asserts that the company’s holdings in Kazakhstan and the Permian Basin are responsible for this anticipated expansion. Over the following five years, Chevron’s downstream and chemicals businesses are also anticipated to expand.

From the average annual return of 15% reported between 2014 and 2019, Chevron intends to boost its adjusted return on capital employed for its downstream and chemicals operations to roughly 18%. This surge is partly due to the anticipated rise in polyethylene demand, which is anticipated to expand at a 3% CAGR over the next five years.

Since roughly a century ago, Chevron has been a publicly traded company and its shares have traded on the New York Stock Exchange. It is now the only energy company included in the Dow Jones Industrial Average, and given recent decades, its history is all the more incredible.

Conclusion

Given the quickening of the economic recovery, the International Energy Agency (IEA) is hopeful about the future growth of the oil market. To reach 96.7 million barrels per day in 2021, the world’s oil demand is expected to increase by 5.7 million barrels per day.